Unlocking Payer Insights Hidden in Specialty Pharmacy Data

By Ashwin Athri

With more and more specialty pharmacy products being launched (and in the pipeline) using a combination of sophisticated distribution, complex dosing and administration, high-cost and high-touch patient services requirements, the reliance of pharmaceutical manufacturers on specialty pharmacy is only getting stronger.

Understanding the payer’s influence on patients access and adherence to medications is also becoming increasingly important as various payers look to implement utilization management tools for the high-cost medications; this can significantly impact not only the patient’s brand experience but also the overall utilization of the medication.

It is more critical than ever for analytics teams to understand the power and control that payers are having on their brands, and which policies can hurt or help them in the marketplace. Rising pressures on margins have led to the prioritization of predictive analytics, as organizations look for insights to support commercial decision making.

With this, there are a few challenges that arise for commercial analytics teams as they look to unlock insights to support commercial decision-making from the data they are receiving from the specialty pharmacies as part of the contracts

- Traditional data sources from retail pharmacies and switches may have a low or negligible capture of the prescription and claims volume for these brands

- Geographic granularity in data may be limited

- Certain payers, channels, or systems may not be reporting the required data

- Contracts with specialty pharmacies may have inconsistent data requirements across the specialty pharmacy partners

- Very limited or inaccurate or unreliable information about the payer and beneficiary type and subtypes in the data from specialty pharmacies

These challenges are increasingly common across the industry and though not all of the issues can be addressed based on the nature of the distribution channel and the data capture, there are certain processes when put in place that can make the data richer and unlock some of the hidden payer insights available.

The first key lies in the fine print of the contract with the specialty pharmacies. By ensuring that the required payer fields are marked as mandatory (and not optional) and by enforcing the service-level agreements in the contract, manufacturers can greatly improve the quality of the data coming back into their systems.

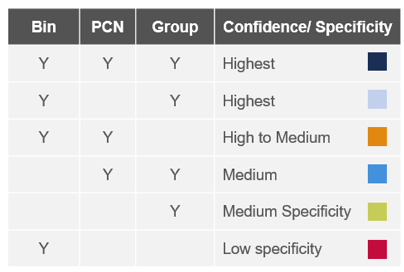

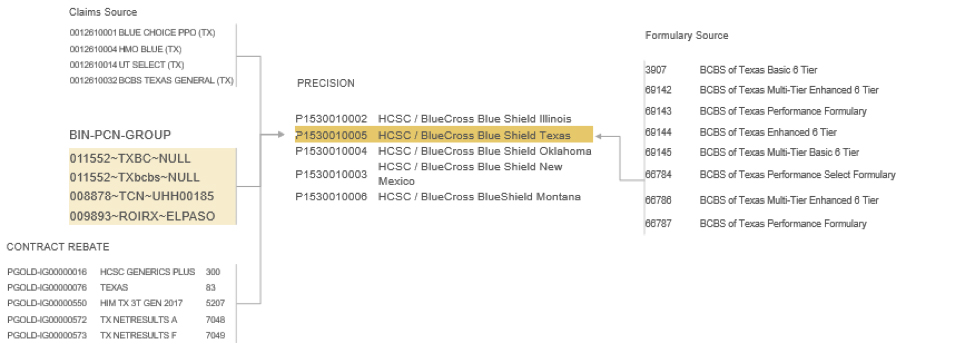

The second key lies in the primary and secondary BIN/PCN and group information that is available in most of the specialty pharmacy data sources. These numbers represent the payer information encoded for claims processing. The BIN is the bank identification number (most industries have moved to issuer identification numbers or IINs) that is a remnant of credit card electronic transactions. These BINs in healthcare represent the pharmacy benefit manager (PBM) that is processing the claims. The PCN is a processor control number that is not always used but when available in a transaction can help unlock the health plan that the transaction refers to. The group number is vital as it describes the specific benefit group of the patient to determine the deductible, OOP, and other benefit details for the transaction. Many employers can choose the same benefit; however, an employer can have many benefits.

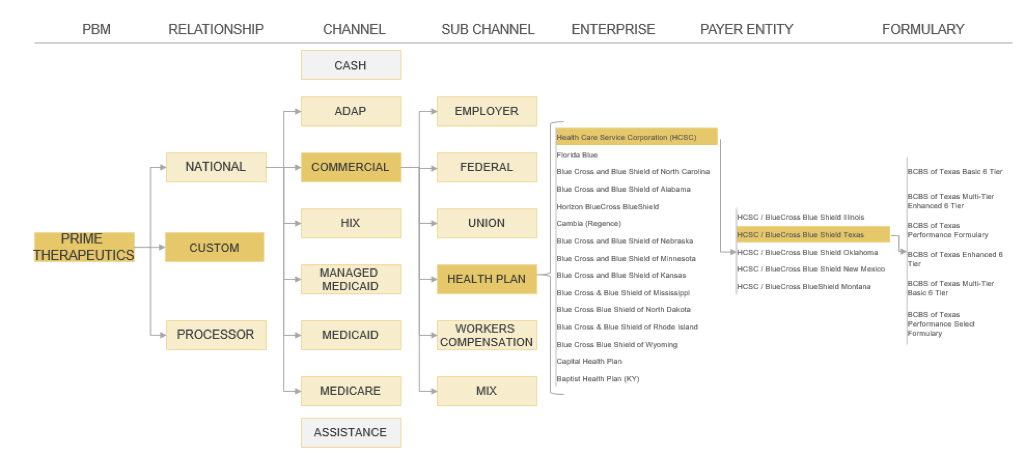

The vital activity to unlock the insight now is to map the BIN/PCN and group numbers when available to the appropriate level in a payer master. Doing this assigns a specific plan in a beneficiary type (eg, Commercial, Medicare, Managed Medicaid, FFS Medicaid) that is part of a specific payer, which uses a specific PBM to each of the transactions. Once complete, the data set can now be rolled up and down to analyze plan, payer, and PBM insights.

Figure 1: Confidence and specificity of match given the available data points in the BIN/PCN/Group fields

As the BIN/PCN/group numbers are universal truths, they are not dependent on a specific drug, therapeutic class, or manufacturer. These translations to a plan, payer, and PBM can be made centrally and used across the industry.

Figure 2: Payer master example for Prime Therapeutics with relevant granularity and accuracy in representing accounts

Figure 3: Example of connecting BIN/PCN/Group values for HCSC/BCBS Texas Commercial to the payer master, which also connects to other data sources such as claims, rebate, and formulary data

The third key and the most complex to solve for is to infer the patient’s payer information from sources outside the specialty pharmacy data. By implementing the same protected health information (PHI) de-identification software on the claims and the specialty pharmacy submitting the data, it is possible to link patient-level data across the 2 sources while being HIPAA-compliant. Once instituted, the claims for the patients outside the drug-specific transactions in the specialty pharmacy data is now available to create a more complete picture of the patient’s payer coverage. This provides the medical and pharmacy coverage details from all other claims submitted for the patient in the larger claims universe and derive the payer coverage for that patient.

By also keeping consistent to the payer master nomenclature in these translations, the earlier step and this one can be combined to create a clean and robust payer database for the patients flowing through data systems. The payer master can then connect this patient-level data set with payer information to other sources of payer data (eg, formulary, rebate) to amplify the potential analytic insights.

As these scenarios are now becoming increasingly commonplace, it is good to know that these are all solved problems and the solutions exist. Data systems and analytic road maps can be built with confidence knowing that the payer insight can be extracted even from a seemingly parched source. This also helps build better workflows for HUB, patient services, and reporting teams and enables sophisticated predictive algorithms that can help ensure a better patient journey.